A simple loan solution to finance your renovation work

Financing for Co-owners

through the Condominium Association

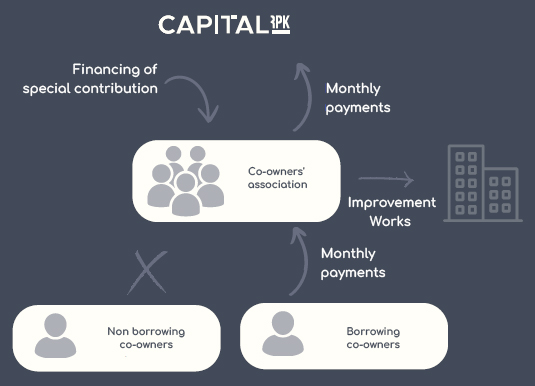

An unforeseen event or unbudgeted work? It’s not always easy for a syndicate of co-owners to raise the necessary funds in time. Sometimes, some co-owners can’t afford to pay a special assessment, which can delay important work and increase the risk to the building. Capital RKP has created a unique financing solution tailored to the needs of syndicates and their co-owners.

A choice of financing for everyone

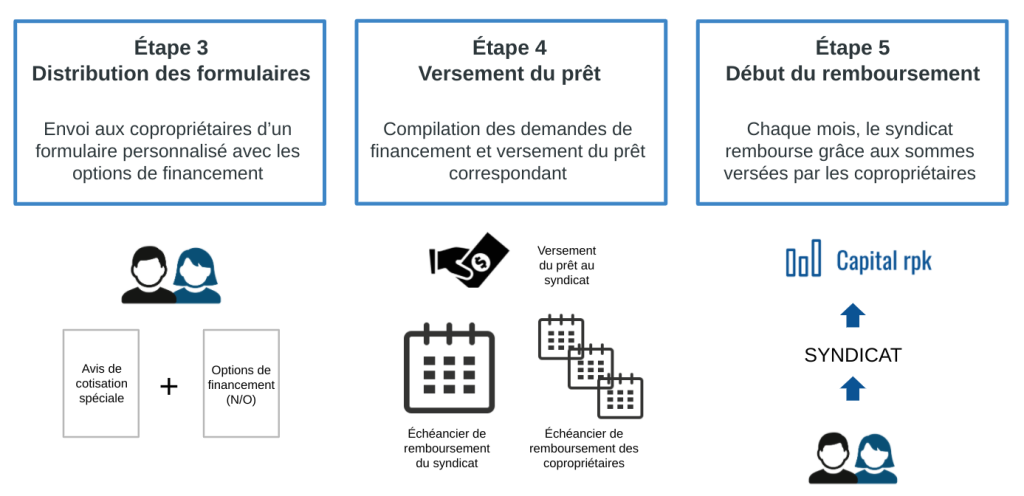

Co-owners who need it can opt for financing and choose the repayment period.

An advance for the syndicate

Capital RPK immediately pays all the contributions financed, enabling the syndicate to start work immediately.

Simplified repayment

Co-owners repay the syndicate in monthly installments, added to their usual charges, and the syndicate repays Capital RPK.

Custom made

A Tailor-Made Solution

Developed with the RGCQ and condominium legal experts, our offer guarantees an optimal legal structure for all.

Thanks to Capital RPK, syndicates can move ahead with their projects, while co-owners benefit from a flexible solution to preserve their building.

Evaluate Your Payments

Simulation Result:

-

Monthly Payment:

-

Total Amount:

- Interest Rate:

*This repayment amount is an estimate based on the information you provided. It is for illustrative purposes only. Actual repayment amounts may vary. This calculation does not constitute a quote, loan approval, agreement, or advice from Capital RPK and does not consider your personal or financial situation.

Of all sizes

Available for condominiums with 6 to more than 500 units

Across Quebec

In major urban centers and rural areas

All types of projects

Renovation or improvement works

What are the terms of the loan?

Every case is different, but loans are generally made over a period of 1 to 5 years at a rate comparable to that of a personal line of credit at major financial institutions. Loans are repayable in full at any time, with no fees or penalties.

What are the benefits for the syndicate?

The financing option offered by Capital RPK costs nothing to the syndicate or to the co-owners who do not use the financing. Only those who decide to fund their membership fee incur an additional cost, which translates into an interest rate on the amount funded.

For the syndicate, there is no additional risk because it has all the usual remedies in the event that a co-owner does not make his monthly repayments. This option gives it greater flexibility in terms of its cash flow and the possibility of obtaining the amount of contributions in time for the implementation of projects.

What are the advantages for co-owners?

For co-owners, the Capital RPK program offers a financing opportunity to those who do not have cash available at the time of contribution and whose borrowing options are limited or more expensive. One of the advantages for co-owners is that assessment funding directly from the condominium association does not affect the borrower’s credit rating.

Transparent

Capital RPK answers your questions

What is the cost for the co-owners who pay the special contribution without financing it with Capital RPK?

No. When issuing a notice of special assessment, each co-owner decides whether or not to appeal for this financing. Those who do not use the funding do not pay anything.

However, by using Capital RPK, the syndicate makes sure that all co-owners are able to pay the special contribution on time. This allows work to start on time and ensures fairness between all co-owners.

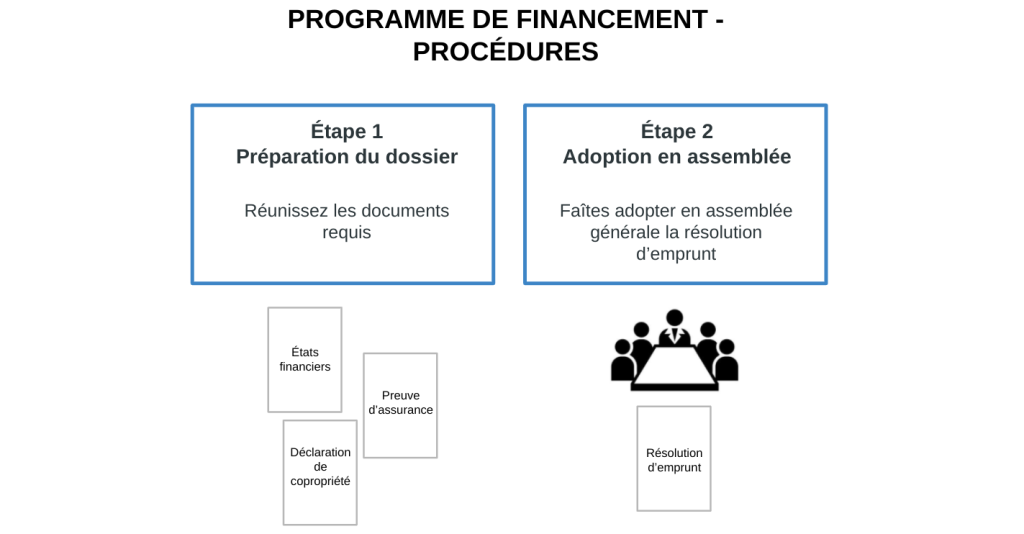

What is the procedure for obtaining a loan?

Once your file has been evaluated and accepted, a loan resolution usually has to be passed at the General Meeting of co-owners. Once the resolution has been passed, each co-owner has access to the various financing options. In the month following disbursement of the loan, co-owners who have opted for financing begin repaying their syndicate, which in turn repays Capital RPK.