Unexpected renovation work? Unbudgeted expenses?

Living in a condominium can have some challenges. Sometimes an unforeseen event or work that has not been budgeted for can cause the syndicate of co-ownership to ask for a special contribution from the co-owners.

But not everyone has the necessary cash. In practice, it often happens that one or more co-owners cannot cope with this call for funds. This can then force the co-ownership to delay the planned work, with all the inconvenience and risks that this entails.

By offering co-owners a financing solution, Capital RPK gives the syndicate the possibility of obtaining the full amount required by the date set to move forward with its projects and thus fulfill its mission of preserving the building.

Capital RPK, a tailor-made solution for syndicates of co-ownership … and co-owners

Developed with the RGCQ, Capital RPK’s solution was developed with a legal team specializing in condominium law in order to establish an optimal legal structure for syndicates and co-owners.

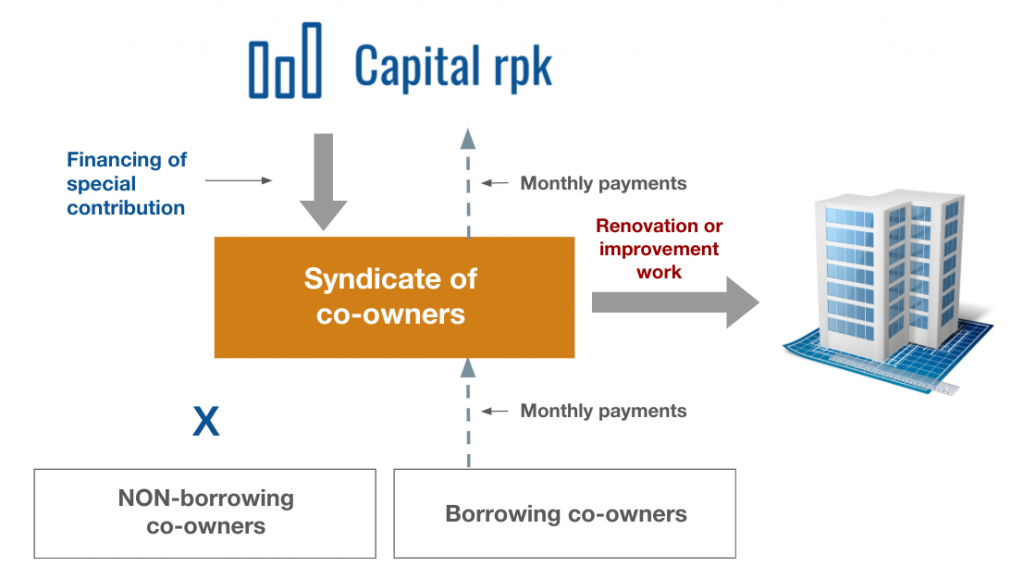

When issuing a notice of special assessment, co-owners who do not have the funds can opt for the financing solution offered by Capital RPK.

Capital RPK then pays the syndicate the total amount of the contributions of all the co-owners who have opted for financing, on the date of contribution. The union therefore has the necessary sum at the desired date.

From the following month, the monthly repayment installments of the co-owners are added to the monthly common charges that they usually pay to the syndicate, which reimburses Capital RPK.

Schematically, the Capital RPK solution works as follows:

Questions? Consult the Q&A section.